Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- The upper timeframe construction remained bullish.

- A dip to the help degree at $0.065 might supply a shopping for alternative.

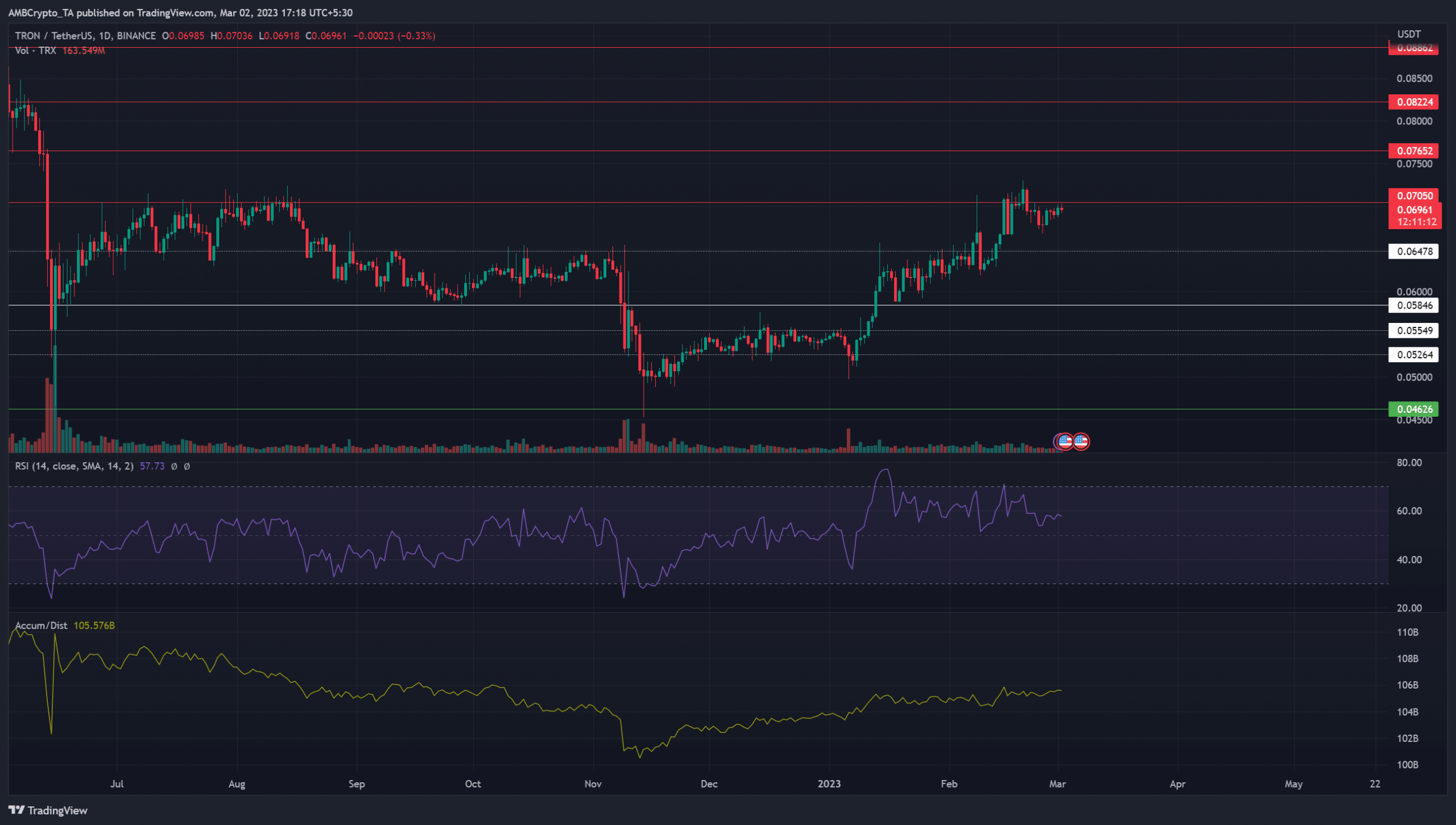

The value motion of TRON [TRX] had sturdy bullishness behind it. The rally that started in January has not but stopped on the upper timeframes, as TRX continued to make larger highs and better lows.

Learn TRON’s [TRX] Worth Prediction 2023-24

A retest of a zone of demand to the south might supply a shopping for alternative. Though Bitcoin [BTC] noticed some losses lately, TRX has carried out effectively total. This could possibly be an indication of energy from the token.

One other section of consolidation beneath resistance might see one other transfer larger

Supply: TRX/USDT on TradingView

TRON was in a transparent uptrend after the breakout previous $0.055 in mid-January. Even when Bitcoin confronted rejection at $25.2k and fell by near 7%, TRX noticed solely a 5% decline and has already floor its approach upward.

An imminent degree of resistance the value confronted was at $0.07. It could possibly be just like the resistance at $0.064 that TRX consolidated beneath for near every week. It was adopted by a powerful upward transfer on 7 February, a retest of $0.06 as help and a continuation within the uptrend.

The A/D line has moved larger and better since December, and it was potential that the shopping for stress might push costs larger. The RSI additionally continued to remain above impartial 50, which confirmed an uptrend in progress since January.

The $0.064 degree has been an necessary resistance since September 2022, and the breakout previous this degree meant bulls had been firmly within the driving seat. A drop under $0.058-$0.062 can be required to flip the bias to bearish. After $0.07, the subsequent vital resistance degree was at $0.076.

Lifelike or not, right here’s TRX’s market cap in BTC’s phrases

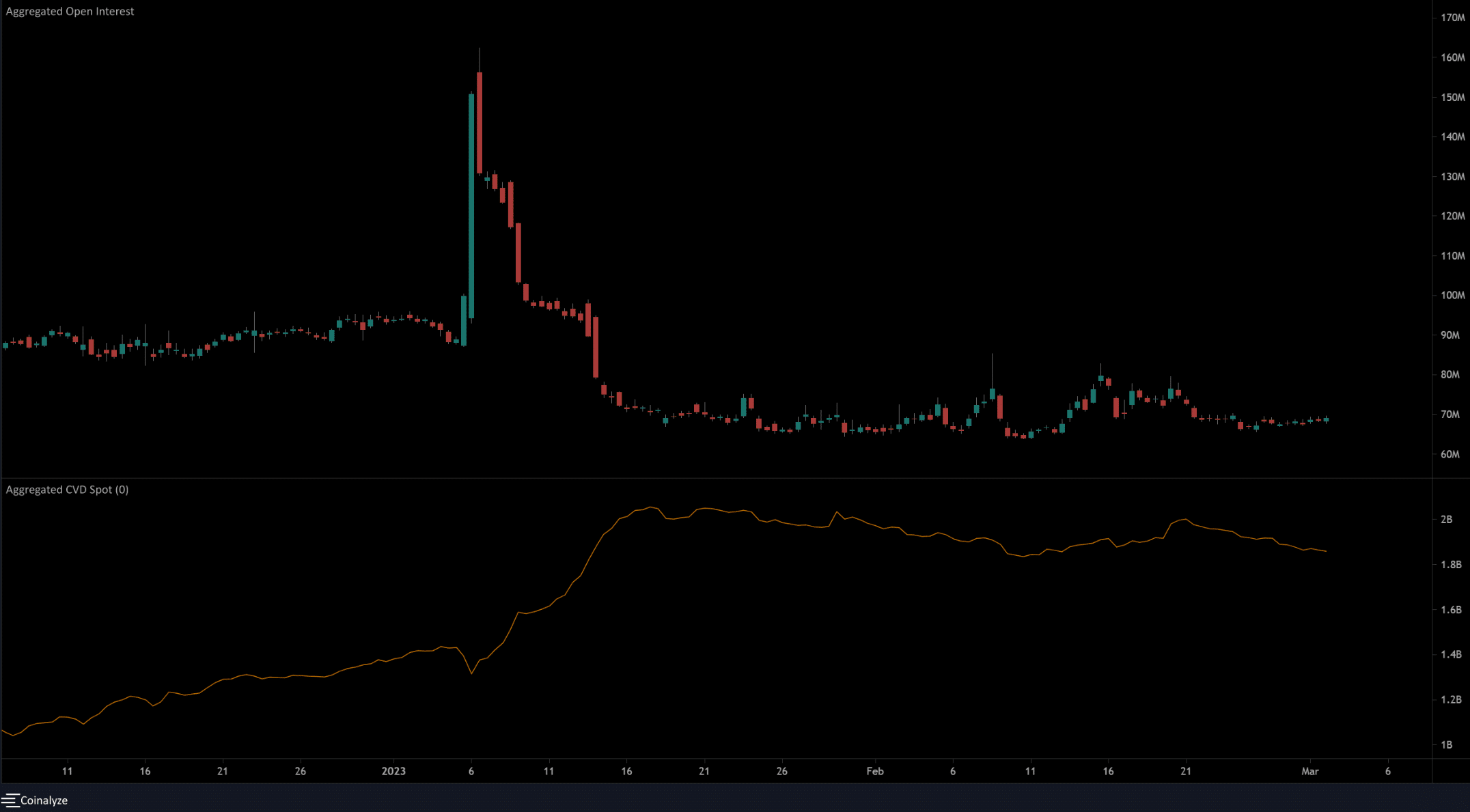

The Open Curiosity confirmed bullish sentiment however demand could possibly be in decline

The strikes larger on 8, 13, and 20 February measured 6.1%, 11%, and three%, respectively. Throughout these spikes in costs, the Open Curiosity additionally pushed larger. The retracement of those strikes noticed a corresponding dip in OI as effectively. This indicated bullish momentum was in play, and that the market individuals weren’t involved in shorting TRX as a lot as shopping for it.

In distinction to the rising A/D line, the spot CVD has step by step declined over the previous two months. The decline after 21 February was particularly noticeable, which confirmed promoting stress on the rise.