- USDT has been battling FUD round it in latest months on account of its publicity to collapsed tasks like FTX.

- Tether has made a transfer to cut back its secured mortgage to make sure the steadiness of the token.

The previous couple of months, particularly following the FTX collapse, have been tough for USDT because the foreign money has been the goal of worry, uncertainty, and doubt (FUD).

Many individuals now want clarification on whether or not or not the stablecoin can preserve its worth after being so closely uncovered to failed ventures. Nonetheless, Tether, the issuer, has come out in a latest launch to elucidate its plans to fight FUD and preserve stability.

Secured loans to stop

Tether indicated that it might cease making secured loans in 2023 in a press release on 13 December. The USDT issuer mentioned in an official statement that ranging from 13 December and persevering with till 2023, it might decrease the worth of secured loans in Tether’s reserves to zero.

This was in response to latest assaults on USDT, based on Tether. Though, it made clear that the secured loans it retained in reserves had been overcollateralized and supported by liquid belongings.

The legitimacy of USDT’s backing has been questioned, amongst different expenses. The latest transfer was to guard the USDT and decrease the corporate’s publicity to doubtlessly risky investments.

Tether additionally declared a number of months in the past that it might remove all of its industrial paper holdings to guard the asset higher. Following the elimination of its industrial paper belongings, it additionally declared an funding in authorities bonds.

USDT change netflow quantity spikes

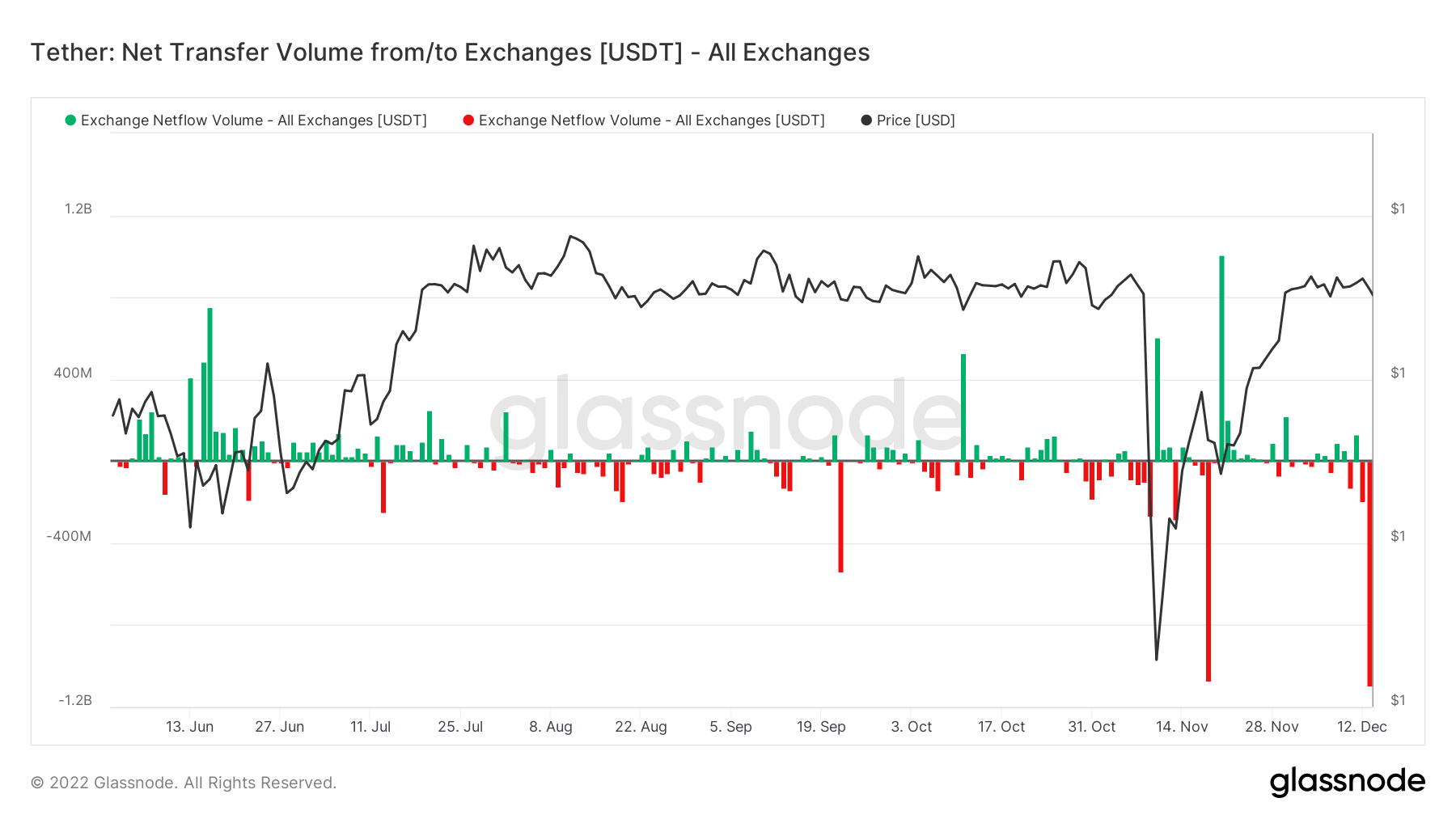

Lately, there was a big outflow of USDT from numerous exchanges through the previous 48 hours. Traders regarded to have been on a withdrawal binge, judging by the Trade Netflow quantity gathered from Glassnode.

On 12 December, greater than $190 million was withdrawn, which is a typical market transfer if a deposit had been made throughout that point. Nonetheless, on 13 December, the withdrawal spiked to over $1 billion, confirming the latest FUD surrounding the token.

Supply: Glassnode

Secure on main exchanges

CoinMarketCap statistics confirmed that USDT continued to have the best market share by market capitalization. Statistics from Nansen additionally revealed that when in comparison with different stablecoins– aside from the change’s stablecoin–the quantity of USDT held on main exchanges was within the majority.

On the time of writing, almost $4 billion price of USDT quantity was seen on Binance. With virtually $2 billion holding, OKX had the second-highest quantity of the asset.

Supply: Nansen