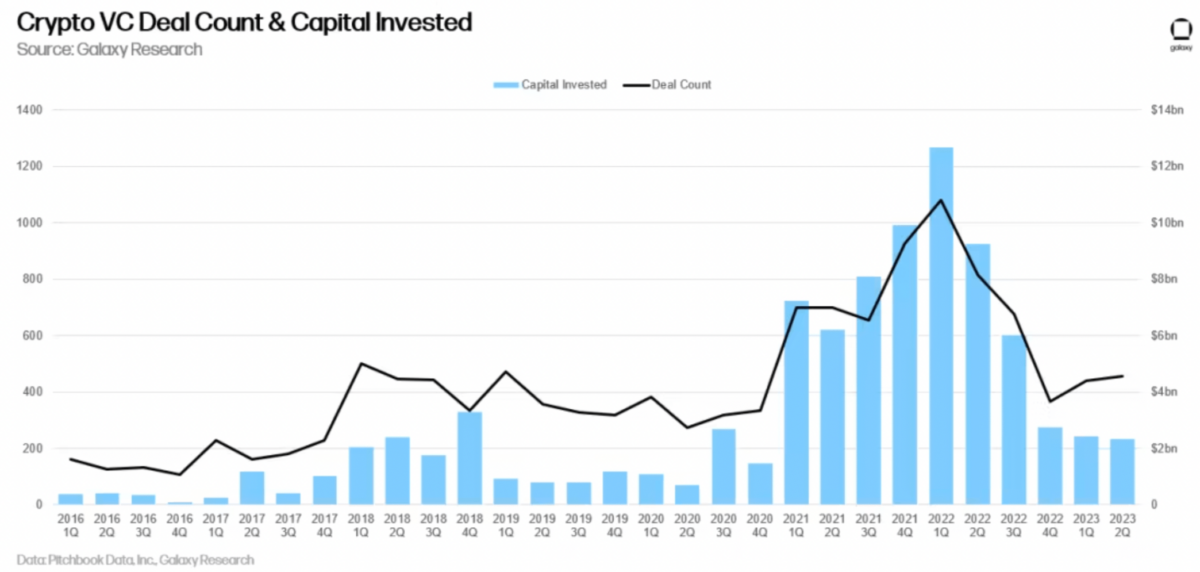

Enterprise capital (VC) funding within the cryptocurrency and blockchain sector is on a downward trajectory, in accordance with a recent report by Galaxy Analysis. The second quarter of 2023 noticed crypto and blockchain corporations receiving $2.3 billion from VC corporations, a big drop from the identical interval final 12 months when greater than $8 billion was invested. Wanting again additional to the COVID-19 pandemic, the crypto trade skilled a monumental surge in enterprise capital, with a report $13 billion invested in Q1 2022. The present difficult enterprise surroundings coupled with rising rates of interest has led to a discount in deal move, in accordance with the report.

“Capital invested has not but discovered a transparent backside. Rising charges proceed to scale back allocator appetites to guess on long-tail threat belongings like enterprise funds,” the report said. This decline marks the fifth consecutive quarter the place VC funding in crypto corporations has decreased. With the digital asset area in its infancy, enterprise capital has continued to play an important position in offering funding to startups in trade for fairness or tokens.

Not all dangerous information

Apparently, whereas the overall funding quantity has decreased, the variety of offers has barely elevated, rising to 456 from 439 within the earlier quarter. The report additionally famous a big 275% progress in offers involving firms centered on privateness and safety merchandise, whereas infrastructure-based options got here in at 114 p.c.

By way of sectors inside the crypto area, startups centered on buying and selling, exchanges, investing, and lending attracted probably the most capital, with $473 million invested.

Listed here are the biggest offers of the quarter, ranked by sector and trade:

- Layer 2/Interop sector skilled the largest deal of the quarter, with LayerZero elevating $120 million Sequence B spherical;

- Corporations centered on Web3, NFTs, Gaming, DAOs, and the metaverse, collectively obtained $442 million;

- The largest deal within the Web3 and NFT area for the quarter was cross-chain NFT market Magic Eden, and its current $52 million deal.

- Blockchain options supplier Auradine had the largest infrastructure deal at $81 million; and

- River Monetary had the largest Buying and selling/Trade deal at $35 million.

A lightweight on the finish of the crypto tunnel?

Regardless of regulatory challenges, the report means that crypto startups within the U.S. proceed to draw important consideration from enterprise capitalists. This means that the current regulatory actions by the U.S. Securities and Trade Fee (SEC) haven’t fully deterred traders.

With Ripple Labs’ small authorized victory towards the SEC wherein a choose dominated that gross sales of XRP on exchanges don’t represent a “safety,” and a excessive degree of authorized scrutiny being paid to the SEC’s prior approval of Coinbase’s 2021 S-1 submitting, some within the Web3 area are questioning if the aggressive method of U.S-based regulators might be in for a sea change.

The Galaxy report revealed that 45 p.c of capital invested in crypto firms was directed at U.S.-based corporations, adopted by the UK at 7.5 p.c, Singapore at 5.7 p.c, and South Korea at 3.1 p.c.

Nevertheless, the lower in VC funding, in accordance with the report, just isn’t unique to the crypto sector. Tighter financial circumstances have impacted VC corporations’ means to proceed elevating funds in 2023 for investments throughout numerous sectors, together with the continued bear market coupled with “the spectacular blowups of a number of venture-backed firms in 2022” which have left many allocators feeling “burned.”

Editor’s observe: This text was written by an nft now workers member in collaboration with OpenAI’s GPT-4.