- The continued decline within the worth of stablecoin USDN led to a fall within the worth of WAVES.

- With unfavourable sentiment trailing the token, the possibilities of an upside are restricted.

Regardless of current claims that Neutrino USD [USDN] will not be intrinsically linked to Waves [WAVES], the current troubles of the algorithmic crypto-collateralized stablecoin led to a extreme decline within the worth of the token.

In a blog post revealed on 8 December, the ecosystem confirmed that the incessant de-pegging of its USDN stablecoin couldn’t improve its volatility as “USDN is a separate venture constructed on Waves blockchain that makes use of WAVES as collateral” and “it isn’t intrinsically linked to WAVES token.” Nonetheless, as USDN’s worth dropped, it pulled WAVES down with it.

Learn Waves’ [WAVES] Worth Prediction 2022-23

Trying to revive confidence in these property, the founding father of the WAVES protocol, Sasha Ivanov, assured buyers that the USDN stablecoin could be effective and that the token wouldn’t be lowered to zero worth, in a tweet on 20 December.

To keep away from misunderstanding: $usdn will do effective.

It’s simply it’s time to create a protocol extra attuned to the present market situations. It is going to be simpler to stabilize usdn first and launch the brand new protocol after.

So guys pls save your breath, waves will not be going to zero lol.

— Sasha.waves (@sasha35625) December 20, 2022

Nonetheless, in a later tweet, he confirmed his determination to launch a brand new stablecoin; an act that didn’t strengthen buyers’ confidence.

Two issues:

– I’ll launch a brand new secure coin

– There’s gonna be a $USDN scenario decision plan set in movement earlier than.— Sasha.waves (@sasha35625) December 20, 2022

Additional, on 21 December, Ivanov requested for a number of centralized exchanges, together with Binance, Kraken, OKX, and Bybit, to disable the futures marketplace for the token. In accordance with the founder,

“They’re a breeding floor for FUD and earning money off brief positions, worthwhile due to it.”

#Waves doesn’t want $waves futures markets. They’re a breeding floor for FUD and earning money off brief positions, worthwhile due to it.

I kindly ask all #cex‘s to disable Waves futures markets.@binance @kucoincom @krakenfx @HuobiGlobal @okx @Bybit_Official

— Sasha.waves (@sasha35625) December 21, 2022

All makes an attempt to calm fears a couple of potential demise spiral for WAVES have been futile, as many believed that the token would finally fail.

Your sacrifice won’t be forgotten.$WAVES to zero quickly pic.twitter.com/C1vJZGQ26u

— Brandon Hong (@brandank_cr) December 21, 2022

WAVES in an ocean of losses

As of this writing, WAVES exchanged arms at $1.50. In accordance with CoinMarketCap, the asset’s worth declined by 58% during the last two weeks.

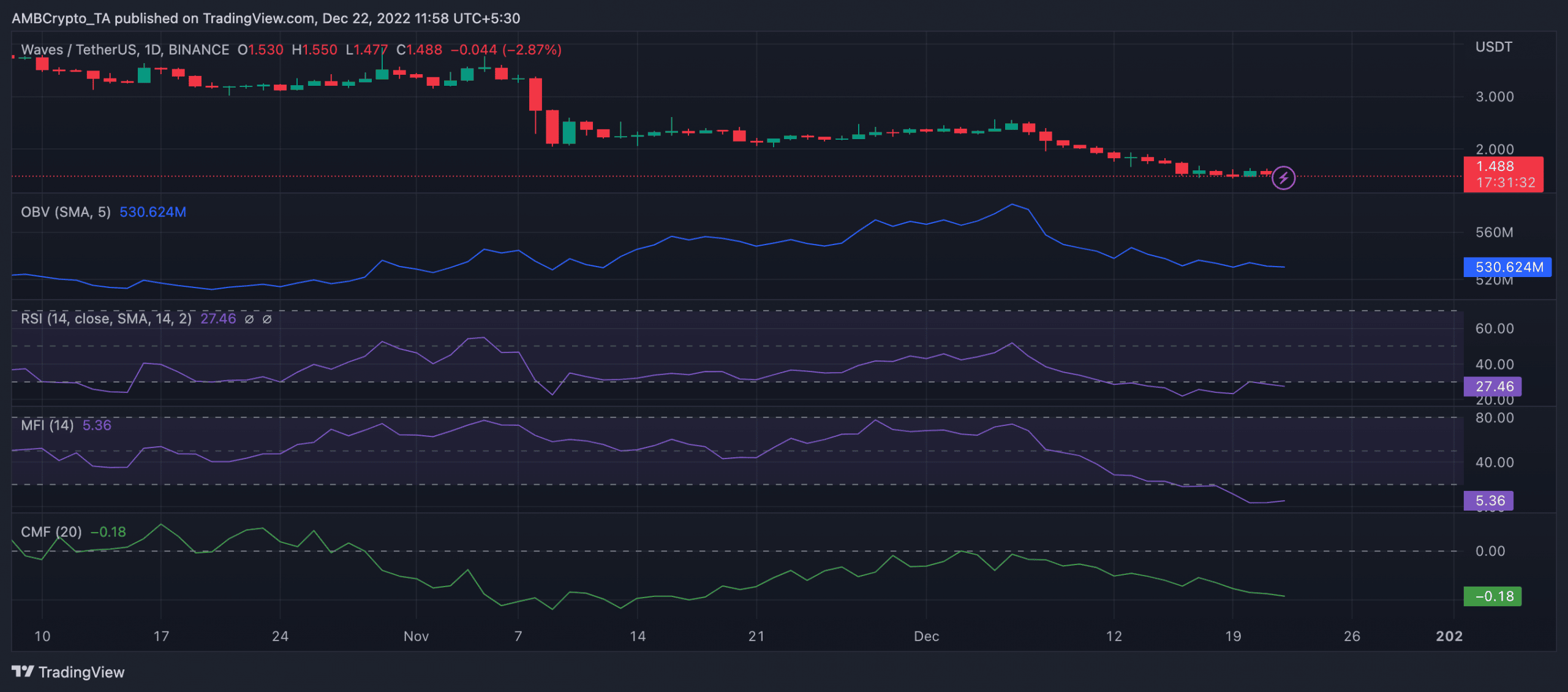

WAVES’ evaluation on a each day chart revealed that the token had been severely distributed prior to now few weeks. In consequence, as its worth fell, many holders exited the market whereas struggling important losses on their investments.

Additional, the token’s Cash Circulation Index (MFI) rested at 5.36 at press time, exhibiting that it was oversold. Likewise, its Relative Power Index (RSI) was noticed removed from its impartial place at 27.46.

Are your WAVES holdings flashing inexperienced? Test the Revenue Calculator

WAVES’ on-balance quantity (OBV) declined by 8% within the final two weeks and was pegged at 530 million at press time. Often, when an asset’s worth and its OBV are making decrease peaks and decrease troughs, the downward development is prone to proceed. With elevated unfavourable sentiment trailing the token, its downtrend may persist.

Lastly, WAVES’ Chaikin Cash Circulation (CMF) rested beneath the middle line in a downtrend at -0.18. A unfavourable CMF is anticipated in a seller-dominated market, and an additional decline must be anticipated with the state of issues within the ecosystem.

Supply: TradingView