A quant has defined how this bearish divergence in Bitcoin on-chain information can result in a short-term correction within the value.

Bitcoin Quick-Time period Holder SOPR Has Been Slowing Down Regardless of Worth Going Up

As defined by an analyst in a CryptoQuant post, a spot has been forming within the buying energy of short-term holders and the BTC value. The related indicator right here is the “Spent Output Revenue Ratio” (SOPR), which tells us whether or not buyers within the Bitcoin market are promoting their cash at a revenue or at a loss proper now.

When the worth of this metric is bigger than 1, it means the general market is realizing some quantity of revenue at the moment. Then again, values under the edge recommend the common holder is seeing some loss in the meanwhile. Naturally, the indicator at precisely equal to 1 implies the buyers are simply breaking-even on their funding.

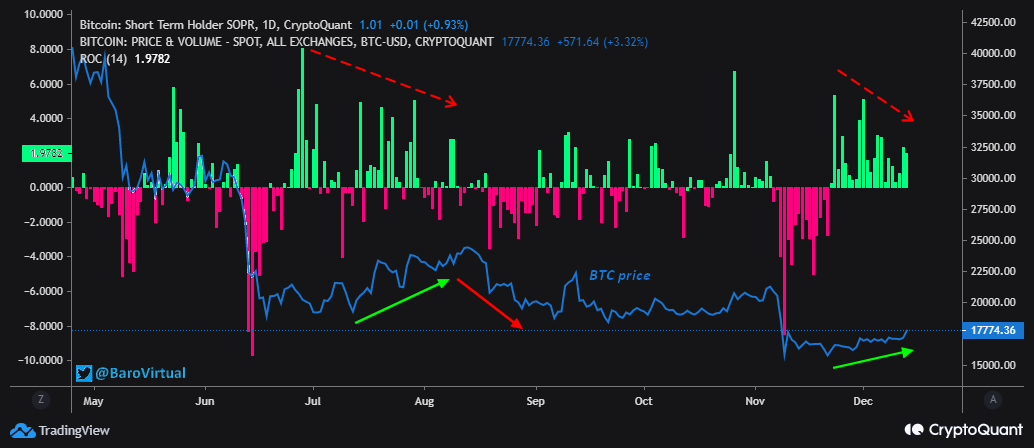

The “short-term holder” (STH) group is a Bitcoin cohort that features all buyers who purchased their cash lower than 155 days in the past. The STH SOPR thus measures the revenue ratio of promoting being performed by these holders. To correctly assess the habits of this group, the analyst is utilizing a “charge of change” (ROC) oscillator for the indicator. Here’s a chart evaluating this momentum oscillator with the BTC value over the previous couple of months:

Seems just like the metric has been taking place in current days | Supply: CryptoQuant

Because the above graph exhibits, the ROC of the Bitcoin STH SOPR had been in deep crimson when the FTX crash came about, suggesting that these buyers capitulated throughout it and realized a considerable amount of loss. Nonetheless, because the BTC value has slowly improved from the lows, the ROC has develop into inexperienced. This suggests that the STHs who purchased through the lows have been promoting for earnings, resulting in a rising SOPR.

Bitcoin has continued to see an uptrend not too long ago, however surprisingly, the STH SOPR ROC has been dropping off. This may very well be an indication that not many STHs have been in a position to purchase throughout these lows, hinting that their buying energy is low in the meanwhile. If they’d been shopping for by means of this rally, they might have continued to reap an increasing number of earnings as the value goes up, however that has clearly not been the case.

Such a divergence additionally fashioned within the reduction rally seen earlier within the bear market, because the quant has marked within the chart. “Final time, this example led to a bearish correction,” notes the analyst. “If this alignment repeats, then this time, Bitcoin could right to the $16,500-$17,000 vary.”

BTC surges up | Supply: BTCUSD on TradingView

On the time of writing, Bitcoin’s value floats round $17,700, up 5% within the final week.