Amid stories of Twitter ceasing its crypto-integration scheme, Dogecoin [DOGE] misplaced over 11% of its worth in 24 hours. The memecoin had surged by greater than 130% following Twitter’s acquisition by outspoken DOGE supporter Elon Musk, Binance‘s help for the buy-out, and a short market restoration.

Right here’s AMBCrypto’s Value Prediction for Dogecoin for 2022-2023

Now, Silicon Valley’s Platformer has noted that Twitter plans to develop a crypto-wallet past the present Bitcoin [BTC] integrations which were paused.

Whales to save lots of the day or not?

Regardless of Platformer’s insider report, Dogecoin whales didn’t halt their actions. On the time of writing, Dogecoin Whale Alert revealed that over $18 million value of the memecoin had moved from pockets to pockets over a 24-hour interval.

🐕🪙🐋🚨

12,354,379 $DOGE ($1,451,986 USD) was transferred from a number of wallets to an unknown pockets.

Price: 5.00 ($0.59 USD)

Tx: https://t.co/eMJ6J83gWJ#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

— Ðogecoin Whale Alert (@DogeWhaleAlert) November 4, 2022

🐕🪙🐋🚨

4,699,967 $DOGE ($554,201 USD) was transferred from a number of wallets to an unknown pockets.

Price: 4.72 ($0.56 USD)

Tx: https://t.co/XJS03dGbTV#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

— Ðogecoin Whale Alert (@DogeWhaleAlert) November 4, 2022

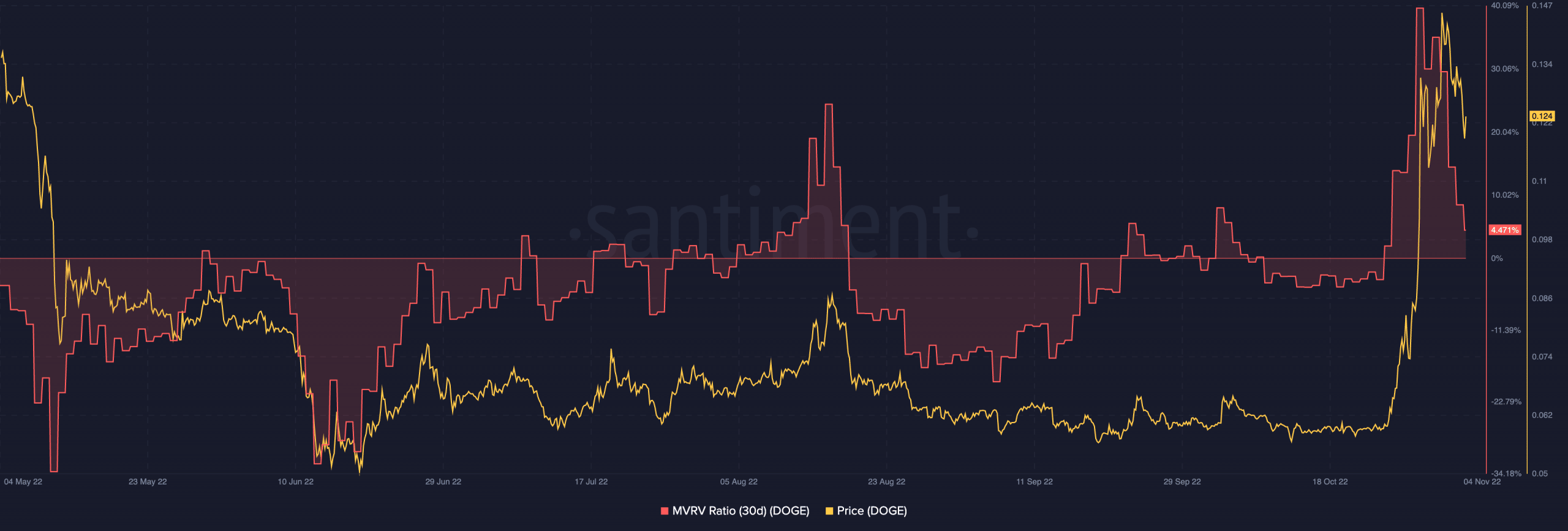

With massive transactions, traders might need anticipated DOGE to stabilize or, at worst, lower minimally. Nonetheless, these weren’t the circumstances that adopted. Actually, in response to Santiment, the market might need taken again the revenue recorded by traders throughout the most-recent rally. This was as a result of indications of the Market Worth to Realized Worth (MVRV) ratio.

The on-chain analytics platform confirmed that the thirty-day MVRV ratio plunged from 39.81% on 29 October to a miserly 4.47%. The pattern meant that latest days led traders to losses quite than income.

Moreover, DOGE short-term traders might need additionally had an impression contemplating the opportunity of sell-offs after making excessive positive factors inside a brief interval.

Supply: Santiment

Contemplating this place, it’s evident that DOGE whales had little impression on what was successfully an uptick. Nonetheless, the MVRV ratio was not the one affected sufferer.

Santiment additionally revealed that DOGE was hit by a decline on different fronts too.

It’s a November fall season

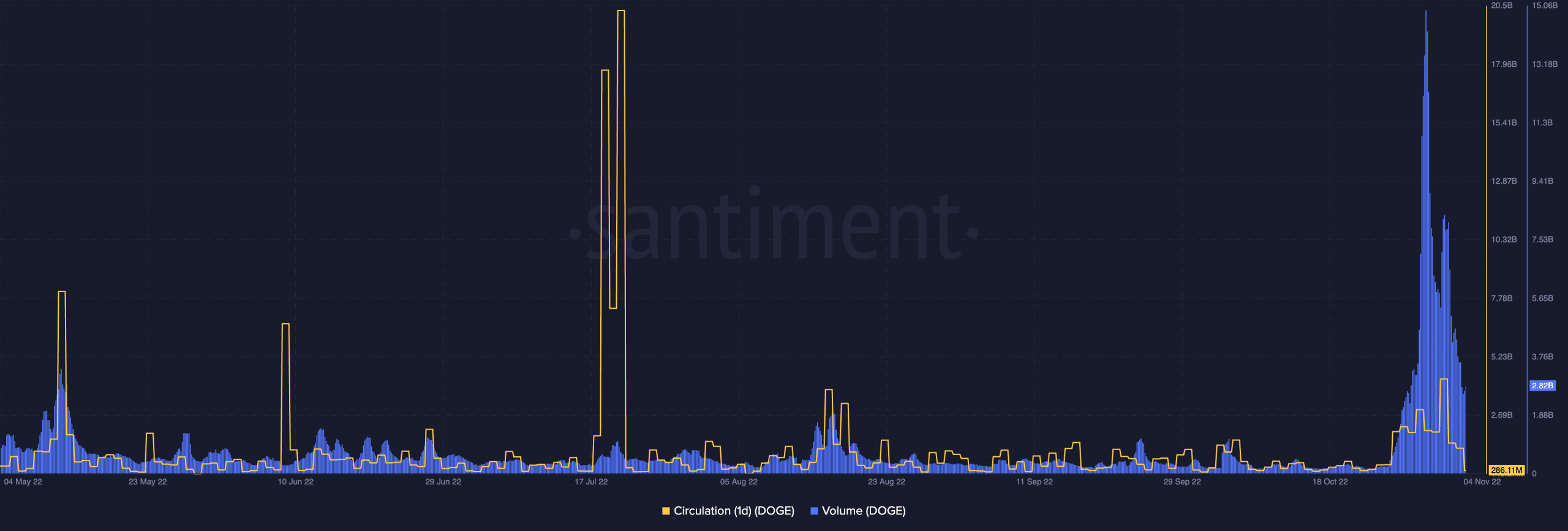

On assessing the one-day circulation, Santiment disclosed that the 4.05 billion worth on 2 November dipped considerably. At press time, Dogecoin’s one-day circulation was 286.11 million. This lower implied that traders have slowed their use of Dogecoin for transactions or any exercise over the past 24 hours.

In related circumstances, DOGE’s quantity fell by 27.10%. With a worth of $2.81 billion, it turned manifestly clear that Twitter’s hesitation alone won’t be the only purpose for the plunge. Therefore, the dip quantity signified that traders had an impact on Dogecoin’s mixture revenue or loss transactions.

Supply: Santiment

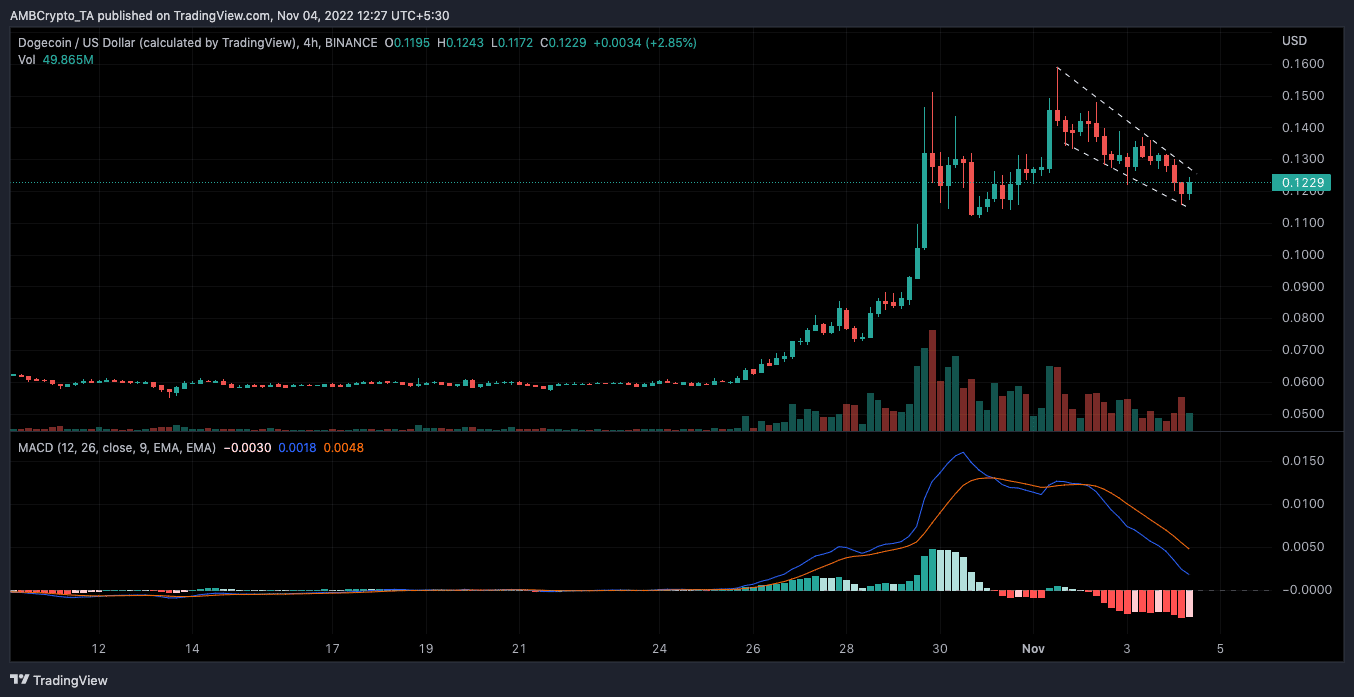

On the four-hour chart, it didn’t appear to be DOGE was close to restoration. This, as a result of the coin regularly misplaced its help zone, falling from $0.1254 to $0.1147 at press time.

As well as, the Transferring Common Convergence Divergence (MACD) indicated that sellers (orange) have been now in command. In addition to the promoting energy, the 12 to 26 EMA remaining under the histogram midpoint virtually licensed that DOGE may be bearish within the quick time period.

Supply: TradingView

![Why Twitter isn’t always Dogecoin’s [DOGE] friend on the price charts](https://ambcrypto.com/wp-content/uploads/2022/11/1667553882961-e04dac77-0690-4ab9-b4f7-6f851e7664e2-1000x600.png)