- BTC whales have intensified accumulation in the previous few weeks.

- Whereas promoting stress has lowered, shopping for momentum has not been sufficient to drive up costs.

Following the considerably bullish cycle between 2020 and 2021 that induced Bitcoin [BTC] to report an all-time of $60,000, the extreme bearishness that has plagued the 12 months to this point induced BTC whales to cut back their provide, additional drawing down the worth of the main coin.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

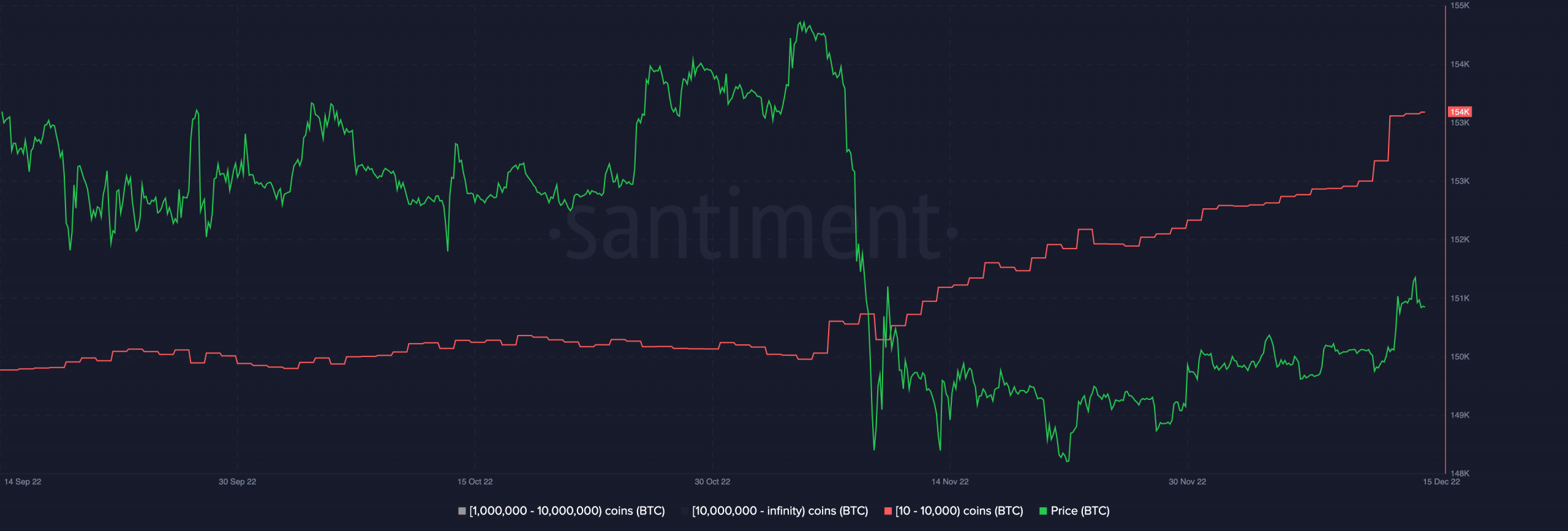

Nonetheless, a change in sentiment amongst BTC whales has been noticed as this cohort of holders intensified accumulation prior to now few months, information from Santiment revealed.

Based on the on-chain analytics platform, prior to now 10 days, BTC addresses holding between 100 to 10,000 BTC scooped up 40,747BTC value over $726 million.

Moreover, the variety of new addresses holding between 100 to 10,000 BTC has elevated quickly over the previous three weeks (159 new addresses). This represents the quickest development on this class of addresses in 10 months, which coincides with elevated uncertainty and worry (FUD) following the announcement of the Russia-Ukraine struggle.

Supply: Santiment

Is aid coming?

CryptoQuant analyst MAC_D assessed BTC’s Spent Output Worth Bands and located that coin distribution momentum was declining.

MAC_D discovered that the sequence of occasions within the final month, just like the collapse of FTX and miners’ capitulation, all of which ought to have led to a chronic decline in BTC’s value, solely impacted the king coin’s value momentarily, after which it rebounded. MAC_D famous,

“There have been a number of crises within the Crypto market this 12 months, however the quantity of whale deposits on the alternate is lowering. The FTX disaster was way more critical than the LUNA disaster, however the decline was a short while and a small drop. Miner Disaster, which may very well be the following, might decrease BTC costs, however it isn’t anticipated to trigger main panic sells,”

Whereas agreeing that FUD nonetheless lingered out there, MAC_D said,

“As a result of the variety of long-term holders has elevated, it’s more likely to be a boring and lengthy decline somewhat than a powerful panic promote.”

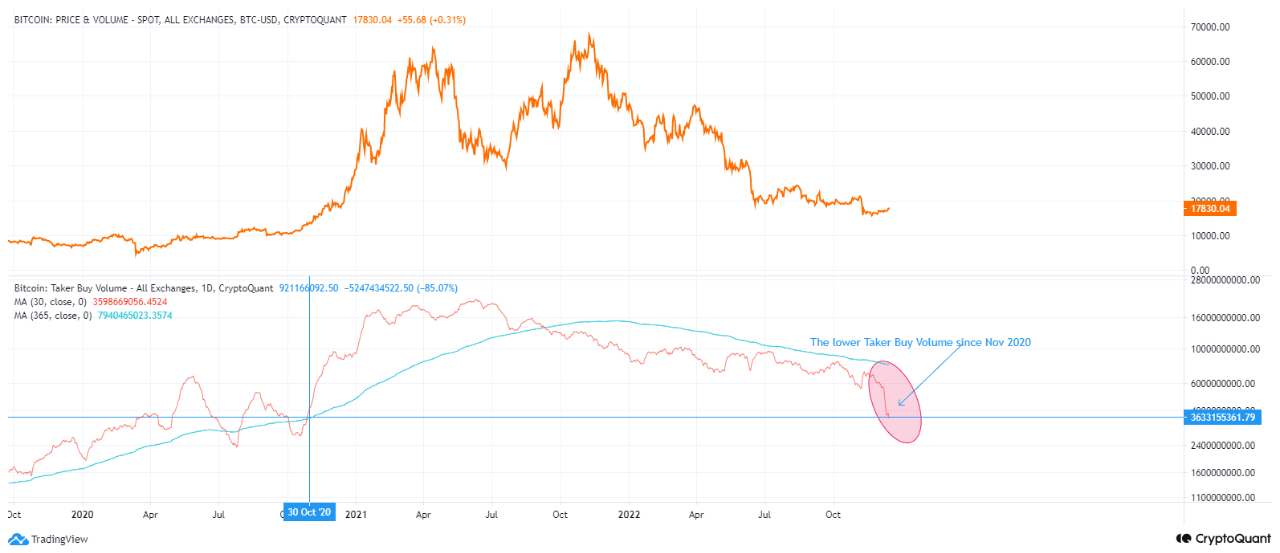

Whereas promoting stress may need dropped and whale accumulation intensifying, BTC’s Purchase Quantity not too long ago clinched its lowest stage since November 2020. The expansion in BTC’s Purchase Quantity momentum often precedes an eventual uptrend in its value.

Nonetheless, per CryptoQuant analyst, Ghoddusifar BTC’s “purchase quantity remains to be downward. and has reached its lowest stage since November 2020.”

Projecting an extra decline in BTC’s value, Ghoddusifar concluded that “we nonetheless can not see an indication of a change within the development.”

Supply: CryptoQuant

![Bitcoin [BTC]: Slowed selling pressure, yes, but what about buying pressure?](https://ambcrypto.com/wp-content/uploads/2022/12/shubham-s-web3-V0f8N73V4To-unsplash-1-1000x600.jpg)